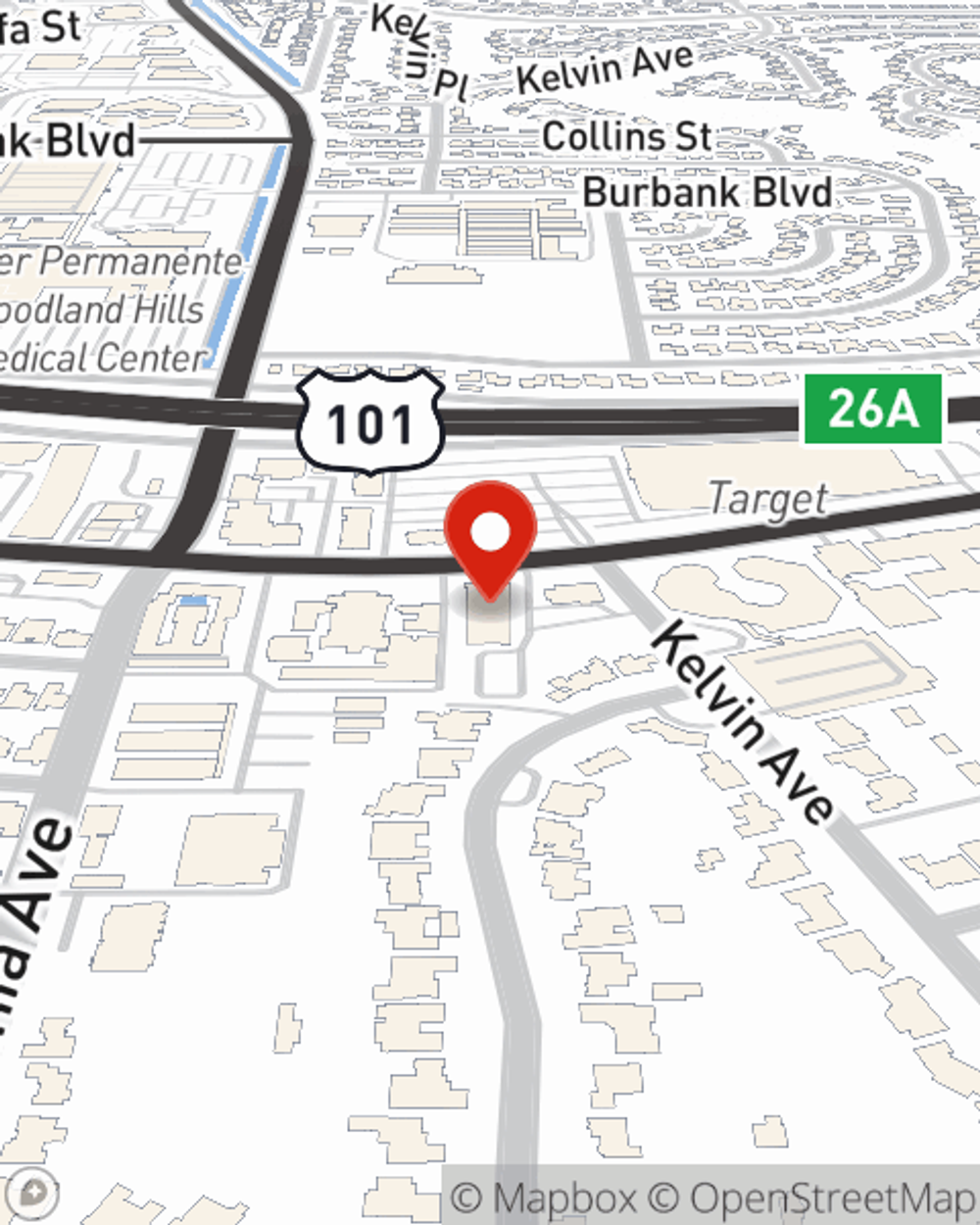

Life Insurance in and around Woodland Hills

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

When you're young and a recent college graduate, you may think Life insurance isn't necessary when you're still young. But it's a great time to start thinking about Life insurance to prepare for the unexpected.

Get insured for what matters to you

What are you waiting for?

Love Well With Life Insurance

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With coverage options from State Farm, you can lock in outstanding costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Walkiria Zarei or one of their knowledgeable representatives. Walkiria Zarei can help design a protection plan aligned with coverage you have in mind.

No matter where you are in life, you're still a person who could need life insurance. Reach out to State Farm agent Walkiria Zarei's office to check out the options that are right for you and those you hold dear.

Have More Questions About Life Insurance?

Call Walkiria at (818) 914-5420 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Walkiria Zarei

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.